The Instant e-PAN service lets you quickly get a PAN card online without dealing with a lot of paperwork or physical documents. Offered by the Income Tax Department, this service is perfect for anyone who needs a PAN card fast for financial transactions or tax-related matters.

This guide will help you register for a new e-PAN, check the status of your PAN application, and download your e-PAN card.

An Instant e-PAN is an electronically issued PAN card that works just like a physical PAN card. It’s a quick, paperless way to get your PAN, and it doesn’t cost anything.

The Instant PAN service was launched by the Indian government on February 7, 2020, allowing people to instantly get a PAN (Permanent Account Number) using their Aadhaar number.

Not everyone can use the instant e-PAN service. Here are the basic requirements:

- New Applicants: This service is only for those applying for a PAN card for the first time. If you already have a PAN card or need to make changes, this service won’t work for you.

- Aadhaar-Linked Mobile Number: You must have a valid Aadhaar card, and your mobile number should be linked to it. Verification is done via an OTP (One-Time Password) sent to your registered mobile number.

- Resident Individuals: The service is available only for individuals living in India, not for companies, firms, or Hindu Undivided Families (HUFs).

- No Modifications: This service is strictly for first-time PAN applicants. If you want to make updates to an existing PAN card, you cannot use this service.

- You also should not be a “representative assessee” under section 160 of the Income Tax Act.

Applying for an New instant e-PAN is quick and straightforward. Here’s how to do it:

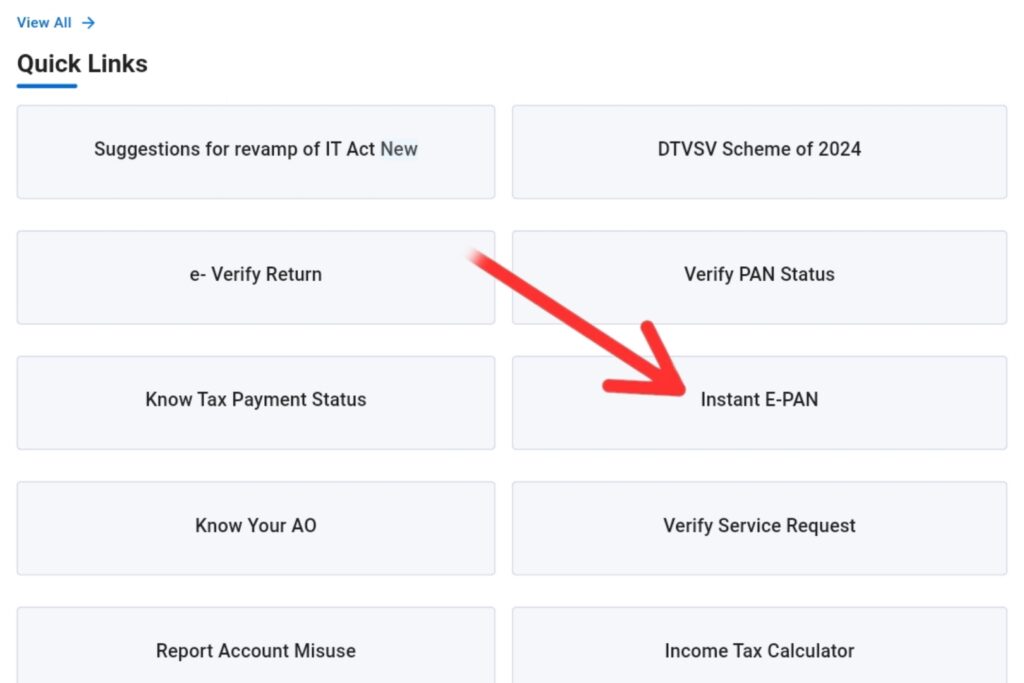

- Go to the e-filing portal: Visit the Income Tax Department’s e-filing portal.

- Click on “Instant E-PAN”: On the homepage, find and click the “Instant E-PAN” button.

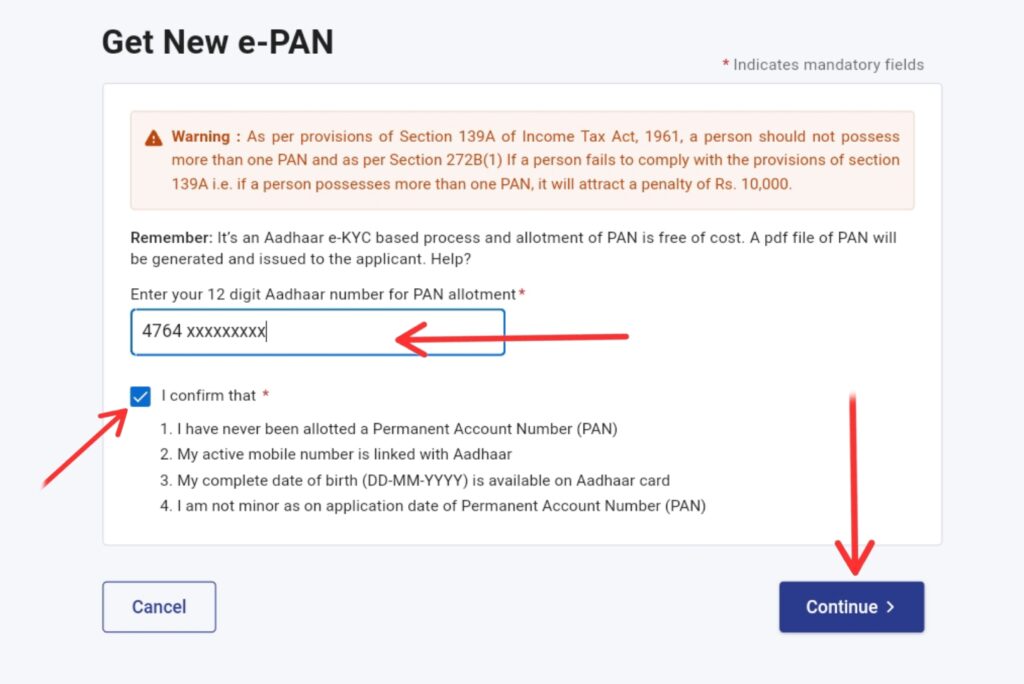

- Select “Get New e-PAN”: On the next page, choose the “Get New e-PAN” option. Enter your 12-digit Aadhaar number to get your PAN.

- Receive OTP: A 6-digit OTP will be sent to your Aadhaar-linked mobile number. Enter this OTP to verify your details and continue the process.

After verifying your Aadhaar, you can easily generate your instant PAN.

You can check the status of your e-PAN and download it on the Income Tax e-filing portal, either by logging in or not. Here’s how:

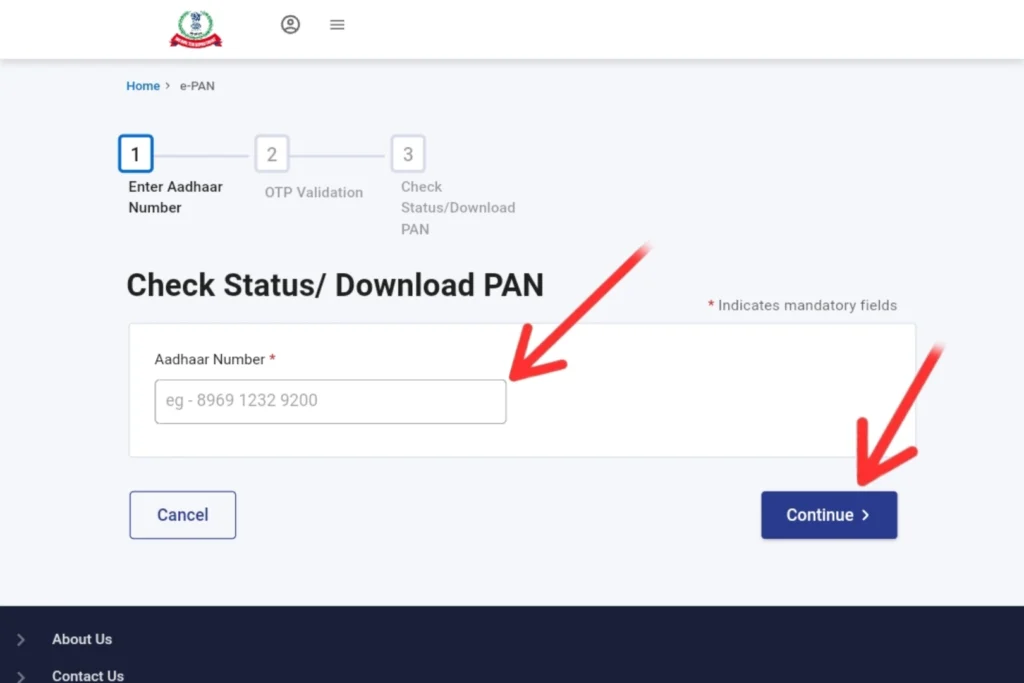

- Visit the e-Filing portal: Go to the e-filing portal homepage and click on “Instant e-PAN.”

- Click on “Check Status/Download PAN“: On the new page, select this option.

- Enter Details: Input your Aadhaar number and the captcha code, then click “Continue.”

- Enter OTP: Enter the OTP sent to your registered mobile number and click “Continue.”

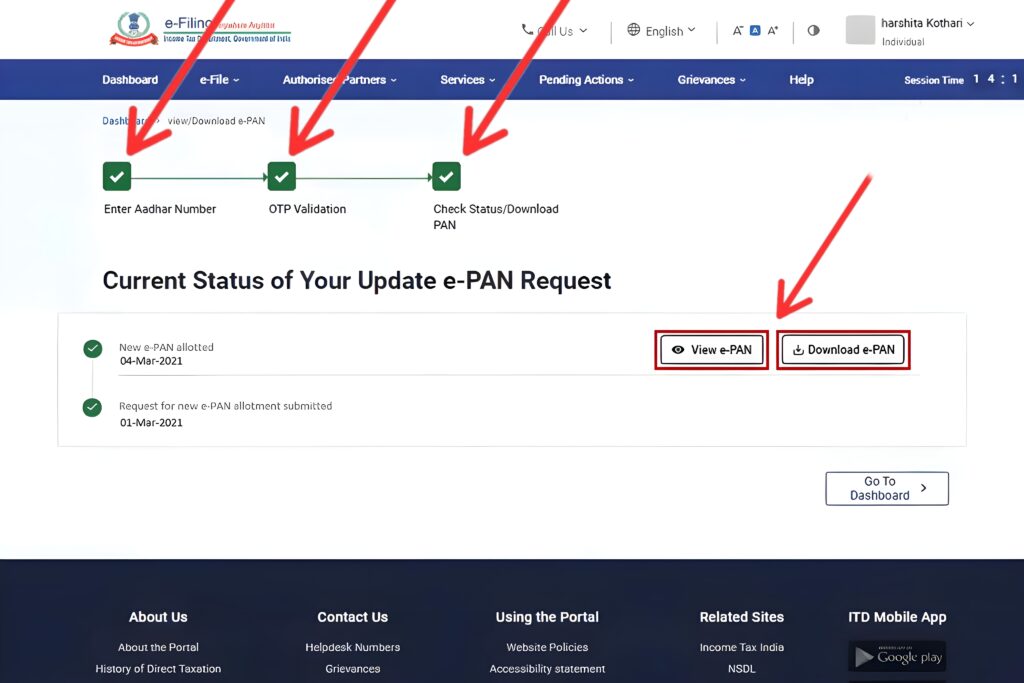

- Check Status: The status page will show your e-PAN request status. If generated, click on “View e-PAN” or “Download e-PAN.” You can also create an e-filing account here.

Important: If the status of your application displays ‘Pending,’ it indicates that your e-PAN is still under processing. You can check again later by following the same steps.

- Log in to the e-Filing portal: Use your User ID and password (created after receiving your e-PAN).

- Enter Login Details: Enter your ID (PAN/Aadhaar/User ID) and your password.

- Access Dashboard: On your dashboard, click “Services,” then select “View/Download e-PAN” from the dropdown menu.

- Enter Aadhaar Number: Input your 12-digit Aadhaar number and click “Continue.”

- Enter OTP: Input the OTP received on your mobile and click “Continue.”

- View/Download e-PAN: On the “View/Download e-PAN” page, you can view or download your e-PAN card.

What is Instant e-PAN?

Instant e-PAN is a facility provided by the Income Tax Department that enables you to quickly obtain a Permanent Account Number (PAN) using your Aadhaar number.

Who is eligible to apply for Instant e-PAN?

Any person with a valid Aadhaar number and a mobile number linked to it can apply for an Instant e-PAN.

Is there any cost for applying for Instant e-PAN?

No, the Instant e-PAN service is completely free, offered by the Income Tax Department.

How fast can I get an Instant e-PAN?

Once you complete the application process, the Instant e-PAN is usually issued within 10 minutes.

Can I use the Instant e-PAN service if I already have a PAN?

No, this service is exclusively for individuals who don’t have a PAN. Having multiple PANs is illegal and can lead to penalties.

Is the Instant e-PAN valid like a regular PAN?

Yes, the Instant e-PAN is fully valid for all purposes where a regular PAN is required.