PAN (Permanent Account Number) is essential for every Indian taxpayer. One of the key forms to apply for a PAN card is PAN Form 49A, specifically designed for Indian citizens. Whether you’re a salaried employee, a business owner, or just someone looking to open a bank account, this form is crucial. Let’s break down everything you need to know about PAN Form 49A and how to fill it out.

What is PAN Form 49A?

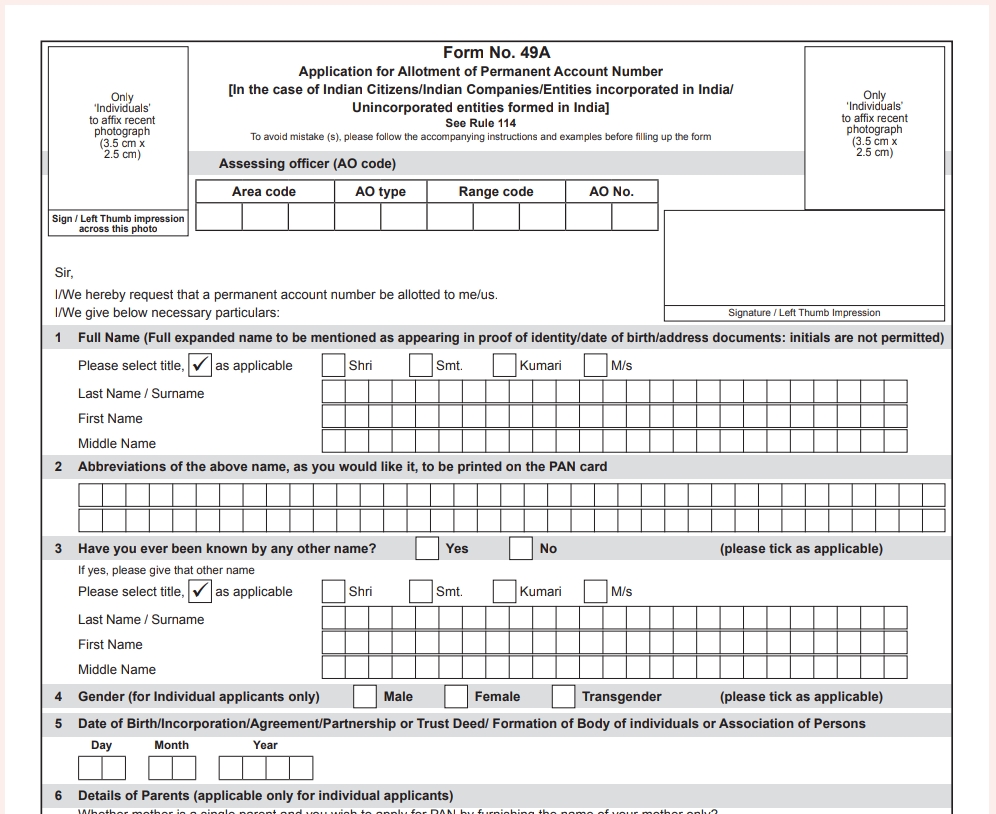

PAN Form 49A is the official document used by Indian citizens or entities to apply for a new PAN card. It’s issued by the Income Tax Department and is mandatory for anyone who wishes to obtain a PAN for tax filing, financial transactions, or investment purposes.

Who Should Use PAN Form 49A?

This form is exclusively meant for Indian individuals, companies, or any entity within India. If you are a non-resident or a foreign entity, you will need to use PAN Form 49AA instead.

How to Fill PAN Form 49A

Filling out PAN Form 49A is pretty straightforward, but attention to detail is important. Here are the key sections:

- Personal Information: This includes your full name, gender, date of birth, and residential address.

- Status of the Applicant: Whether you are an individual, firm, or company.

- Income Details: Information about your source of income, such as salary, business, or property.

- Supporting Documents: Proof of identity, address, and date of birth must be submitted.

Why is PAN Form 49A Important?

Without a PAN card, several financial activities are restricted. Filing income tax returns, making high-value transactions, or even applying for loans becomes difficult without it. PAN Form 49A makes it possible to legally track and document these activities.